forum

library

tutorial

contact

Alcoa Reaches Power Accord to

Avoid Washington Smelter Cuts

by Sonja Elmquist

Bloomberg, May 2, 2016

|

the film forum library tutorial contact |

|

Alcoa Reaches Power Accord to

by Sonja Elmquist

|

Amount BPA estimates it would gain $5.3 million from Alcoa accepting the

proposed amendment rather than keeping with the current curtailment proposal.

Alcoa Inc. won't cut back operations as planned at a Washington smelter after reaching an agreement with its power provider.

The Bonneville Power Administration and Alcoa amended their supply pact, with changes effective from July 1 through Feb. 14, 2018, the New York-based aluminum producer said in a statement Monday. The deal "provides for additional access to market power during this period," according to the statement.

The Intalco smelter had planned curtailments at the site by the end of this quarter. The agreement, combined with $3 million of workforce training from the state of Washington, are "key factors" in the smelter's competitiveness, Alcoa said in the statement. The plant in Ferndale, Washington, has capacity of 279,000 metric tons per year, the company said.

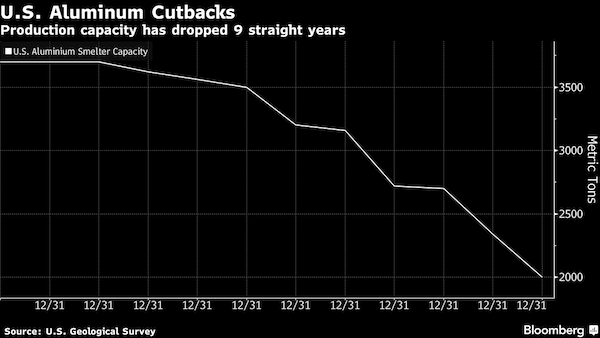

Alcoa is among aluminum smelters that have shut down operations in the U.S. as the metal's price has dropped amid a global production glut. Domestic capacity fell to 2 million metric tons at the end of 2015, the ninth year of declines, according to data compiled by Bloomberg.

Alcoa paid $1.5 million to the BPA, and in exchange can reduce its purchases at a specified rate to 10 megawatts from 75 MW before turning to the open market, the BPA said in documents posted on its website. The agency markets power from 31 government hydroelectric projects in the Columbia River Basin.

The agreement also provides for Alcoa to buy more power from BPA if the price of aluminum traded on the London Metal Exchange rises to or above $1,850 a metric ton on average for 25 straight days, and a further increase if the price climbs to $2,500. Aluminum has gained 11 percent this year to $1,679 per ton, after dropping 19 percent in 2015.

Aluminum commodity historical prices 1990 to mid 2016

Aluminum is a lightweight, corrosion resistant metal used mainly in aerospace applications, as a construction material, in packaging, automobiles and railroad cars. Resources of bauxites, the raw material for aluminum are only located in seven areas: Western and Central Africa (mostly, Guinea), South America (Brazil, Venezuela, Suriname), the Caribbean (Jamaica), Oceania and Southern Asia (Australia, India), China, the Mediterranean (Greece, Turkey) and the Urals (Russia). Aluminum futures and options contracts provide price transparency to the U.S. aluminum market, valued at about $35 billion per year in products and exports.

Aluminum Production Capacity has Dropped Nine Straight Years

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum