forum

library

tutorial

contact

BPA at a Crossroads

by Eric BarkerLewiston Tribune, July 8, 2018

|

the film forum library tutorial contact |

|

BPA at a Crossroadsby Eric BarkerLewiston Tribune, July 8, 2018 |

Battling growing competition and looking at costly upgrades, Northwest power agency is trying to right its ship.

Could dam breaching be a solution?

The Bonneville Power Administration is one of a few self-funded federal agencies that operates like a private concern, but difficult market conditions are eroding the business model it's depended on for decades and threatening to upend its future.

The Bonneville Power Administration is one of a few self-funded federal agencies that operates like a private concern, but difficult market conditions are eroding the business model it's depended on for decades and threatening to upend its future.

In response, the agency is looking at cutting its fish and wildlife budget, among other measures. That could have an impact on the effort to recover salmon and steelhead runs protected under the Endangered Species Act. But some environmentalists say the agency could save money, improve its financial standing and help fish by walking away from costly future upgrades to the four lower Snake River dams.

The agency is also trying to shore up its finances by reducing its debt ratio and maintaining its credit rating while making needed investments to infrastructure, coming up with new products like reliable power for noncontract customers and better meeting the needs of customers.

Cheap renewable energy like wind and solar produced in California and the southwest, along with conservation and the low cost of abundant natural gas, have driven down the price of wholesale electricity and disrupted the market for surplus electricity.

The agency once counted on selling its surplus electricity to places like California for a nice profit, which it used to keep its own rates low. But with prices and demand both down, Bonneville has often been forced to sell its surplus electricity at a loss. It has also had to raise the rates it charges regional customers by about 30 percent in the past decade.

Those customers are locked into long-term contracts and are now paying well above the market price. For instance, Bonneville sells its power for roughly $36 a megawatt. On the spot market, which fluctuates constantly, the price is often around $20 a megawatt, or even lower.

Contract cliff

Agency officials such as BPA administrator Elliot Mainzer are diligently seeking ways to right the ship, particularly prior to the expiration of those contracts held by small and large utilities in the Pacific Northwest. Utilities managers are naturally eyeing the cheaper prices elsewhere. Most of the contracts expire in 2028, but negotiations for renewal are expected to heat up in the next three to four years.

"The trend would not allow them (BPA) to be a competitive power supplier when the next set of contracts are signed," said Scott Corwin, executive director of the Public Power Council, a coalition of publicly owned utilities that use BPA power. "It's an important matter for Bonneville to get control of their costs and turn the trajectory of what have been significant rate increases over the last several rate periods."

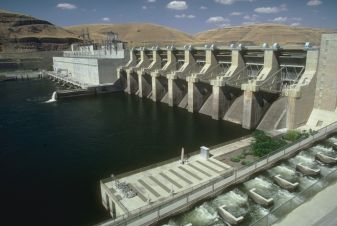

BPA markets power it produces at 31 federal hydroelectric dams and energy produced at the Columbia Generating Station, a nuclear plant in Washington. According to its website, it provides about 28 percent of the electricity used in the vast Pacific Northwest region and maintains about three-quarters of the transmission lines in its service territory. Customers include big public utilities such as Cowlitz Public Utility District and tiny rural cooperatives like Clearwater Power and Idaho County Light and Power.

Clearwater Power, which supplies electricity to homes and businesses in parts of north central Idaho, is keeping a close watch on BPA's efforts to curb costs as well as its rates as the so-called 2028 contract cliff approaches.

"Our cost of wholesale power is about 42 percent of our monthly bills for our members," said David Hagen, Clearwater Power general manager at Lewiston. "It's impacting us. We are concerned about the trajectory Bonneville is on. With rate cases every two years and rising rates depending on the year, it's a concern, especially when you compare it to what the wholesale market is right now."

Hagen said it's too early to say if Clearwater will seek to reduce the amount of power it purchases from Bonneville in the next contract and replace it with other sources. But it's a possibility. It's also a possibility other, much larger utilities will seek to diversify from Bonneville, which could raise rates on those who remain customers of the agency

"I'm guessing we are going to have to make a decision in 2023 or 2024 about those contracts," Hagen said. "Until we know all the terms and the pricing, it's going to be very difficult to make a decision."

The fact that Bonneville customers are at least mentally shopping for better deals has the agency worried. Mainzer said power from BPA, even at a higher price than the volatile spot market, still has value, but he knows rising agency costs and prices are a looming problem.

"We are not strictly competitive on pure price point basis," he told the Northwest Power and Conservation Council earlier this year. "I would say that I still think there is tremendous value in the product. I think right now that when you unpack all the different elements of the Bonneville product - it's carbon free, it's dispatchable, it's firm reliable components and everything else that comes with BPA - I still think it's a tremendously valuable product, but if that (price) spread opens up more I think we are going to face some significant problems."

Anthony Jones, a Boise economist, thinks the agency's above-market rates pose a serious danger. The more utilities choose to reduce their Bonneville purchases, the more the prices will rise for those who remain.

"Big utilities are saying, 'Why don't I cut back on my big contract with BPA and buy at least part of my power on the open market.' It's risky, sure, but if you are willing to assume some risk, there is the potential to do some big savings," he said. "That is a huge problem for BPA. BPA has sort of a fixed level of costs and spreads those costs over its known demand, over customers. If customers cut back, some costs have to be spread over fewer people, and that means higher rates for the remaining customers. It's called a death spiral in economics. It's descriptive and it's true."

The agency also faces liquidity problems and scrutiny from credit rating organizations. To help make ends meet and to avoid further rate hikes, the agency has burned through much of its reserves and used the lion's share of its credit. Mainzer told the Northwest Power and Conservation Council it has spent about $800 million of its cash reserves and $5 billion of its $7 billion federal borrowing capacity. He is trying to maintain at least $1.5 billion in credit and enough cash to fund each of its division for at least 60 days. The agency is seeking nonfederal sources of credit to relieve some pressure.

Bonneville officials are also attempting to retire debt, but at the same time the agency needs to continue to invest about $900 million annually in upgrades to the dams and transmission system.

It all adds up to stressful times for the agency that's mission is to be "an engine of economic prosperity and environmental sustainability," for the region.

Equal consideration

Mainzer said the agency can't get out of its predicament with cost cutting alone and must find new revenue by continuing to sell its surplus electricity, a difficult task given the market.

The agency's costs include debt payments to the federal treasury and its considerable fish and wildlife obligations. With little control over the wholesale market, the agency is seeking to control what it can - its own budget. That will mean a nearly $30 million cut to its $300 million fish and wildlife budget for fiscal year 2019, in addition to cost-saving measures at its other divisions. This comes at a time when the return of Endangered Species Act protected wild salmon and steelhead runs have been declining. Last year, the return of wild B-run steelhead was alarmingly low. By some accounts, fewer than 500 wild B-run steelhead returned to the Columbia River systems. Another estimate by the Idaho Department of Fish and Game puts the still-unconfirmed number at about 1,000.

Whichever is right, it's a low number. Spring chinook returns are far from robust this year, and biologists are not expecting steelhead to make much of a rebound this fall.

By law, the agency must give equal consideration to providing a reliable power system for the region and to helping fish and wildlife populations affected by the construction and operation of dams in the Columbia River basin. To meet its fish and wildlife obligations, the agency's fish and wild program pays for a plethora of projects including hatcheries, habitat improvement in places like Idaho's salmon and steelhead streams and work designed to ease passage of adult and juvenile salmon at the dams.

The fish and wildlife budget jumped in 2008 when the agency negotiated the Columbia Basin fish accords that gave states and tribes a boost in funding in exchange for them not pursuing litigation over the impacts of federal dam operations on salmon and steelhead. Those accords expire this year and are expected to be renewed but for a shorter time span than the original 10-year agreements. Oregon and the Nez Perce Tribe did not sign on to the accords.

The fish and wildlife program is undergoing review and cuts are coming. Thus far, the agency is trying to trim fat without hurting the projects that most help threatened and endangered fish. It will do that by looking to slash things like research, monitoring and evaluation, how much it pays researchers and fisheries managers to attend scientific conferences, and training. It will also look at cuts to programs that can't demonstrate success when it comes to improving fish runs.

"We are really trying to make sure the investments we retain are the highest biological value," said Bryan Mercier, executive manager of Bonneville's Fish and Wildlife Division. "We are not going to do anything that puts us in jeopardy of meeting our ESA obligations."

The agency has indicated that any additional costs, such as spilling water at the dams, needs to be made up with cuts elsewhere. Water spilled at the dams is counted as a cost in the form of forgone revenue because it doesn't run through turbines.

Fisheries officials who receive funding from the fish and wildlife budget are both sympathetic to the position the agency is in but also looking to make sure the agency meets its mitigation obligations.

"They still have a responsibility under the Northwest Power Act to mitigate for the effects of the hydro system and to give equal consideration to fish as the power that is produced. That still needs to be their standing direction," said David Johnson, director of Nez Perce Tribe Department of Fisheries Resource Management.

High-priced assets

Some activists have suggested the agency walk away from the four lower Snake River dams that need costly turbine upgrades in the coming decades and are responsible for a significant portion of the agency's fish and wildlife costs. Breaching the dams is the cornerstone strategy of many Snake River salmon advocacy groups.

Critics are skeptical that selling more power when the market is depressed can succeed.

"Good luck and at what price?" said Linwood Laughy of Kooskia, who worked with economist Jones, journalist Steve Hawley and producer Jim Norton to write a white paper on the issue.

The men say the agency should consider divesting the four dams, which could pave the way for their removal. According to their reasoning, breaching would save money by eliminating the needed upgrades and reduce mitigation costs associated with the dams.

Buried in the agency's five-year strategic plan is this line: "And through the Columbia River System Operations Review, BPA and its federal action agency partners will produce a recommendation on the future of the lower Snake River dams after completing a comprehensive analysis."

The single sentence is devoid of details, but for some it is loaded with foreshadowing regarding the agency's commitment to the dams and the costly upgrades they will need in the next few decades.

"I read that and said the lower Snake River dams are clearly in their sights, and I think they should be," Jones said.

Jones sees the dams as something that can relieve some of Bonneville's financial pressures. The aging dams need turbine rehabilitation that could cost $1 billion-plus, according to Laughy's calculations. The dams are responsible for a large chunk of the fish and wildlife mitigation payments Bonneville is required to make. Work by the Fish Passage Center indicates breaching the dams could lead to a fourfold increase in Snake River salmon and steelhead runs.

"It would actually be cheaper to save the fish than to pretend the dams aren't damaging the fish," Jones said. "Realistically those particular four dams are just very high-priced assets. They generate 53 percent of their power April to June when nobody needs the power and prices are down around $5 to $10 a megawatt and their remaining power the rest of year, and they really don't supply much. Regardless of how well-intentioned they were when (the dams were) put in, they are just not a good fit for the Northwest market."

There is no indication the agency is contemplating a future without Ice Harbor, Lower Monumental, Little Goose and Lower Granite dams. Officials say the dams serve as an important backup source for renewable energy sources. When the wind doesn't blow and the sun is covered by clouds, the dams can be used to take up the slack.

"The way I view those dams, which have very high concrete survival rates (survival rates for juvenile fish passing them) by the way, are very significant in the region for us in integrating renewables such as wind and solar," Mercier said. "They provide a ton of flexibility for us to provide reliability in the region. They are four giant batteries, and those batteries are critical to the operation of a reliable system."

In response to written questions submitted to the agency, BPA spokesman David Wilson said Bonneville plans to invest about $500 million in the lower Snake River dams over the next 20 years. Most of that will focus on equipment that is not directly related to power generation, such as turbines.

Based on the investments, the agency calculates power produced at the dams will cost $13 to $14 a megawatt hour.

"The cost of production is lower than even the most pessimistic replacement power forecasts over the same time period, making the projects cost-effective resources," Wilson said.

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum