forum

library

tutorial

contact

Why BPA Sees Aggregation as

the Future of Demand Response

by Robert Walton

Utility Dive, June 12, 2015

|

the film forum library tutorial contact |

|

Why BPA Sees Aggregation as

by Robert Walton

|

'You just can't have a bunch of individual demand response contracts ... it would just be a nightmare to manage.'

If you can't bring 25 MW of demand response to the table, don't waste John Wellschlager's time.

If you can't bring 25 MW of demand response to the table, don't waste John Wellschlager's time.

Wellschlager, the manager of Bonneville Power Administration's (BPA) demand response (DR) initiative in its territory out in the Pacific Northwest, believes aggregation is the future of successful demand response programs. Today, Wellschlager is heading up the public power provider's efforts to bring reliable, dispatchable DR to the table.

"Demand response is still relatively new in the Northwest," he said. "We have a large flexible hydro base in and out of the Bonneville system, and low rates compared to the national average. And that has not driven the need, quite frankly, for demand response until recently."

But that's changing now. Bonneville faces transmission constraints, the need to integrate intermittent resources, and winter peak loads that stress the system. Over the past year, BPA has been working with load aggregators to test demand response potential, and recently announced the results of a partnership with AutoGrid, which has been scheduling and signaling Bonneville's DR events. Since February, BPA said it has used the system to execute more than 20 events ranging from 18 MW to 28 MW of load reduction.

In total, Bonneville said it has shed more than 500 megawatt-hours (MWh), largely in partnership with aggregator Energy Northwest. A second demonstration project with EnerNOC is still ramping up.

"Aggregation is the key to success for demand response moving forward," Wellschlager said. "In our service area, where you can be serving 9,000 MW to 12,000 MW of load, you just can't have a bunch of individual demand response contracts for 30 KW or 1 MW. Operationally, it would just be a nightmare to manage, and just way too complicated."

Fast, reliable response needed for dispatch

A key aspect of the AutoGrid-BPA partnership is the speed of dispatch. Because BPA wants to use demand response to help balance intermittent loads, it has been requesting load sheds within 10 minutes. To stress-test the system, the power provider has been putting in its request at awkward times.

To accomplish that, AutoGrid is using its Demand Response Optimization & Management System to dispatch events; BPA sends signals to AutoGrid using the OpenADR 2.0b protocol, an open standard dispatch-grade system.

"We've been doing some random testing with Energy Northwest," Wellschlager said. "We've done 24 random tests. We don't tell them when or how long we're going to move the load. We hit them at 1 a.m., we hit them during a shift change, and they've successfully deployed every time."

The demonstration with Energy Northwest, providing up to 35 MW of load shift, will run through January 2016. BPA has started discussing deploying the product simultaneously with system needs, and Wellschlager said if Bonneville moves forward with the partnership the aggregator would be "able to compete for our business the way any other generator would."

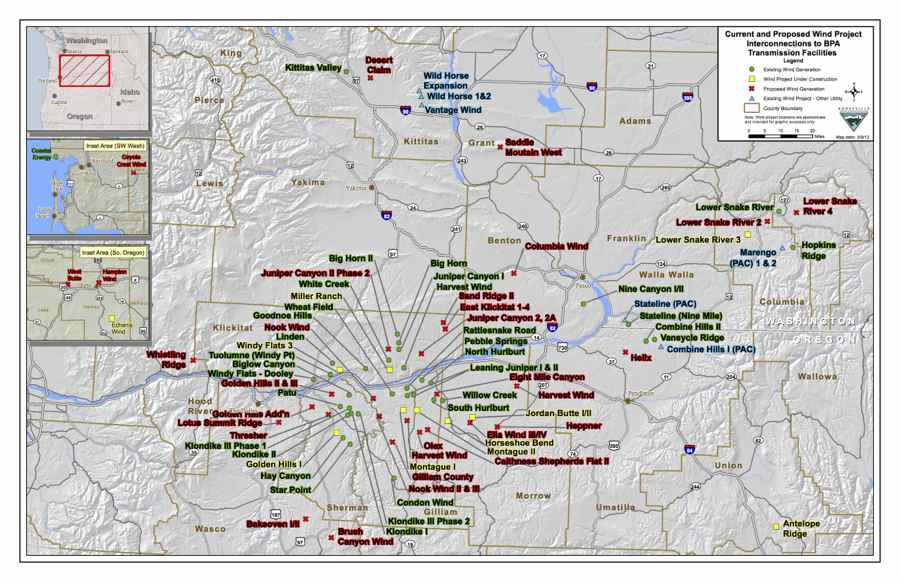

While EnerNOC's program is still getting up and running, it will ultimately target winter peak loads in the mornings and evenings. The Energy Northwest pilot is aimed at integrating intermittent resources like wind, which is pushing 5,000 MW on BPA's system, as well as growing solar capacity. The aggregator has targeted battery banks and pulp and paper loads, but other loads are also being considered. The key is that they can be dispatched reliably and quickly -- something an older model of demand response could not really achieve.

BPA has been buying load reductions from aluminum smelters, when they win a request for offers, over the last year. "They are the perfect demand response resource," Wellschlager explained. They run 24 hours a day, with a large thermal heating load that can be ramped up and down with little impact. But scaling up demand response will mean moving beyond single-entity contracts.

"Once you get past the [direct service industry] contracts, the smelters, it starts to get more complicated because each case has different availability and limits," he said.

That's where the agency's aggregation partners come in. In Energy Northwest's case, BPA is seeing load shifts take place in less than its 10 minute target -- but with the caveat that it is not asking for end users to ramp down power for longer than 90 minutes.

Once EnerNOC is up and running, those DR calls will last three to four hours in order to manage transmission constraints. The company's pilot will run through April 2017, and is expected to begin testing later this year.

The demonstration projects are set up as pay-for-performance. "If they perform, they get paid. If they don't then they take a hit on their capacity payment," Wellschlager explained.

In the case of Energy Northwest, BPA's agreement says they can deploy DR through the aggregator up to twice a week, no more than six times a month. "If we try to deploy and they don't respond, either within the 10 minutes or they don't fully respond to the amount, then they lose one-sixth of the capacity payment for that month," he said.

Aggregation is key

Wellschlager looks for three things in demand response: "It has to be reliable, cost-effective and easy to deploy," he said. "If you don't get all three of those, it's not going to be commercialized."

Direct contracts are not the most efficient way to develop demand response, and the most commercial DR on BPA's system at one point is relatively small -- about 75 MW, according to Wellschlager. Right now, the demonstration projects are not bidding to actually meet Bonneville's needs. But that could change if the projects prove successful.

"The minimum I will accept people bidding into our RFO process is 25 MW. If you don't have 25 MW then it's not worth the administrative process to go through the operational protocols to get you signed up," Wellschlager said. "But if we have someone like Energy Northwest or EnerNOC who is willing to do aggregation and go through all those individual agreements, to provide us with a single signal that volumetrically is big enough to be meaningful to us operationally, that's something we're very interested in."

Conceptually speaking, Wellschlager said, demand response is a fairly simple idea. But utilizing it as a resource, "implementing and sorting it out across a wide range of resource classes that have different avail abilities and characteristics ... is immensely complicated."

Aggregators will likely help Bonneville ramp up its use of demand response in the near future, but just how quickly is uncertainty. "It's going to take some time to sort it out," Wellschlager said. "I would expect it to continue to grow over the coming years. But by how much or how fast is kind of a crapshoot."

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum