forum

library

tutorial

contact

U.S. Hydropower Facing the Future

by Michael HarrisThe Columbian, April 1, 2017

|

the film forum library tutorial contact |

|

U.S. Hydropower Facing the Futureby Michael HarrisThe Columbian, April 1, 2017 |

... finding the capital to perform overhaul and rehabilitation work - even at federal power marketing administration facilities

has been difficult, in spite of collaborative cross-agency maintenance and modernization programs.

Throughout his campaign, U.S. President Donald Trump banked hard on promises of a fossil-fueled renaissance, and many of his cabinet appointments reflect that coal- and oil-heavy philosophy. Likewise, the future of former President Obama's Clean Power Plan, America's commitment to the Paris Climate Change Agreement and the U.S.' role in the so-called "Three Amigos" greenhouse gas reduction partnership with Canada and Mexico remain in the lurch.

This doesn't mean hydro has been completely forgotten, however. A House of Representatives hearing held by the Subcommittee on Energy and Commerce in March indicates hydro is still very much a federal consideration, even as the Trump Administration looks to establish its energy policies. The hearing, "Modernizing Energy Infrastructure: Challenges and Opportunities to Expanding Hydropower Generation," focused on key areas with testimony from industry representatives and advocates.

Throughout his campaign, U.S. President Donald Trump banked hard on promises of a fossil-fueled renaissance, and many of his cabinet appointments reflect that coal- and oil-heavy philosophy. Likewise, the future of former President Obama's Clean Power Plan, America's commitment to the Paris Climate Change Agreement and the U.S.' role in the so-called "Three Amigos" greenhouse gas reduction partnership with Canada and Mexico remain in the lurch.

This doesn't mean hydro has been completely forgotten, however. A House of Representatives hearing held by the Subcommittee on Energy and Commerce in March indicates hydro is still very much a federal consideration, even as the Trump Administration looks to establish its energy policies. The hearing, "Modernizing Energy Infrastructure: Challenges and Opportunities to Expanding Hydropower Generation," focused on key areas with testimony from industry representatives and advocates.

"The transition to a clean economy is happening right now," said Rep. Scott Peters, D-Calif. "America has an opportunity to diversify our energy sources and give our children a future with cleaner air, cleaner water and greater economic opportunities, and hydropower plays an important role." Infrastructure and equipment modernization

The recent spillway failures at California's Oroville Dam cast a national spotlight on America's aging dam infrastructure. This was further emphasized days later with the release of the American Society of Civil Engineers' quadrennial "Infrastructure Report Card," issued in March, in which America's dams received a "D" grade.

Speaking to the subcommittee on behalf of ASCE, Chuck Hookham, a director at CMS Energy Corp., said the needed fixes to America's infrastructure will cost an estimated $4.6 trillion - $2 trillion of which has already been targeted and earmarked for infrastructure repair and improvment. Still, the majority of the projected funding remains outstanding, although a significant federal infrastructure package could help alleviate some of the deficit.

"We are hopeful," Hookham said. "We hear of what President Trump has laid out. We need to make those statements turn into real action. We need to fund - fully fund - dam safety programs. These are really critical to the operations of our facilities both at federal and state levels. We have got some activity going on to get that funding appropriated, both on hydropower and non-hydropower dams. That needs to continue forward. Most of these dams now support or protect people downstream."

The model used by CMS Energy, which operates 13 conventional hydro plants and one pumped-storage project, could be emulated by other private investors to help improve dam safety - assuming federal funding could help supplement private spending.

"Because we are a private investor looking at investing in building hydropower, we can come in and revisit all the maintenance needs, its age, its risks, its perspectives, and invest," Hookham said. "Whether it is a Corps of Engineers dam or Bureau of Reclamation, whatever it is, if we are building infrastructure at that dam, we can reconstitute it effectively back up to today's standards.

"Everybody wins in that scenario. The risks are reduced, the people that live downstream have higher confidence that that infrastructure will last longer, and everybody, theoretically, even the ratepayers, wins, because it is a cost-effective addition."

The longevity and dependability of generating equipment installed at many facilities has also, ironically, become an issue as advances in technology often mean plants aren't producing at their full potential. However, finding the capital to perform overhaul and rehabilitation work - even at federal power marketing administration facilities - has been difficult, in spite of collaborative cross-agency maintenance and modernization programs.

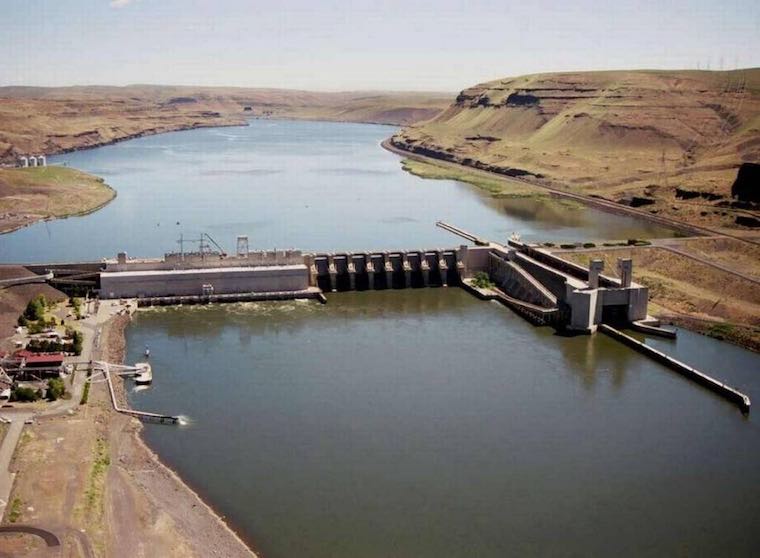

"Historically, because of its complexity, the acquisition process can be cumbersome, resulting in prolonged unit outages and cost overruns," Kieran Connolly, vice president of generation and asset management with Bonneville Power Administration, said during the hearing. "These issues reduce generation, resulting in lost revenue for the PMAs. In turn, these circumstances contribute to rate increases that diminish the product value for power customers."

Regulatory reform

Regulatory reform and an improved licensing process is of particular interest to the House subcommittee given the age and condition of America's dam and hydroelectric infrastructure. According to data from the Energy Information Administration, the 50 oldest power plants in the U.S. are all hydro, and all have been in service for more than a century.

More than 500 projects - or about 50% of all non-federal hydro licenses - will be up for review and renewal before 2030. The challenge of moving such a bulk of projects through the Federal Energy Regulatory Commission's relicensing process is compounded not only by existing red tape, according to Rep. Frank Pallone, D-N.J., but also the lifetime of many FERC operating licenses. These licenses are awarded for terms of 30 to 50 years, which has, in some cases, led to minimal infrastructure maintenance since the time of their original issuance and, in others, to non-compliance with laws like the National Environmental Policy, Clean Water and Endangered Species acts that were enacted in the interim. Duplicative application and licensing procedures spread across overlapping agencies also causes frustration and delays.

"We would like to find a way to streamline that, frankly, by recognizing the importance of stakeholders having an opportunity to make their case," said Committee Chairman Greg Walden, R-Ore. "As this subcommittee continues its efforts to modernize our nation's energy infrastructure through technology, neutral improvements and expansion, we have to bring greater transparency, efficiency and accountability to the regulatory process affecting hydropower."

Although the House committee was able to shepherd several hydro-related bills through Congress during the Obama presidency, some were left to die on the floor - perhaps none more notable than the Energy Policy Modernization Act. The bipartisan legislation included provisions that would have aided both the conventional and marine hydrokinetic sectors but couldn't gain enough traction during Obama's lame duck period. Still, Rep. Fred Upton, R-Mich., said portions related to the hydro market remain a Congressional priority.

"While we were not able to agree on the hydropower reform package in the context of the larger energy bill, significant progress was made, and I am hopeful, I am encouraged and I am optimistic that we are going to be able to deliver this time around," he said.

Even before the White House turnover, legislators were testing the waters with a new two-year FERC licensing process. The pilot program was applied in 2014 to a project being built by Rye Development at the Kentucky River Authority's Lock and Dam 11.

The trial was a success, according to Rye Development Chief Executive Officer Ramya Swaminathan, who spoke on behalf of the National Hydropower Association during the hearing and said an expedited process is essential for making hydro an economically feasible consideration for many developers.

"The timeline for a new hydropower development project to reach commercial operation is between 10 and 13 years, which is almost unmatched in the power generation space," Swaminathan said. "Federal permitting can account for eight to 10 years of that time. And most other energy projects can be built in less than half that time, which means that investors in the energy space are effectively discouraged from investing in new hydropower generation."

Encouraging capital investments

With just 3% of the more than 80,000 dams in the U.S. being fitted to produce hydroelectric power, the picking is ripe for developers to use existing infrastructure for generation. And while costs and timeframes associated with licensing pose two barriers, another is a lack of federal support for public/private partnerships that could, in many cases, benefit government assets.

"These projects - new hydro on existing dams - are an avenue for the federal government to attract private capital to invest in its dam infrastructure, offering measurable benefits to the federal government," Swaminathan said.

The incentive and compensation structure for hydroelectric power generation is also not as conducive for hydropower's growth as it is for other renewables, according to both witness testimony and statements made in the Hydropower Vision plan the U.S. Department of Energy released last year. For private investors like Swaminathan, whose company operates 13 projects, the lack of federal support systems in terms of both legislation and investments can be prohibitive for potential developers.

"We are in a different position because we are funded by private capital, which is a different source of capital and a different pool with different constraints and different return thresholds than a regulated utility," she said.

"So certainly we support regulatory modernization across the whole range of regulation that we face. But, low-cost financing through some of the federal instruments that can do that, as well as potentially a federal standard offer that would provide certainty pursuant to published rates, would be measures that the federal government could adopt that would significantly galvanize private investment because they would provide certainty."

Unlocking the potential of pumped storage

Not forgotten in the subcommittee's discussion was the role pumped storage could have in America's energy landscape, although mechanisms for developing it, like conventional hydro, have not been particularly favorable.

"From an investment point of view, I don't have that incentive," Hookham said.

The need for energy reservoirs - be it in the form of pumped storage, conventional hydro or batteries - continues to rise as many utilities face a growing need to offset the intermittency of growing wind and solar fleets. Even though pumped storage remains by far the largest and most widely used utility-scale storage solution, integrating it into a larger portfolio is still difficult.

"On the commercial side, the conventional wisdom is that you can arbitrage on-peak and off-peak power," Swaminathan said. "But in an environment of very depressed prices, that is very difficult. And the capital costs of pumped storage are very high."

Tapping pumped storage's full potential would likely require a significant rethinking on the federal level about how its benefits are compensated by current electricity rate structures, but the interest at least seems to be there.

"It is important to get the right balance, and how we can harness all those to really work with the renewable energy resources as well, because getting that grid balanced right is very important," Walden said.

The Trump card

"Despite the numerous benefits of hydropower, the greatest impediment facing its growth is the regulatory process," according to Walden.

President Trump has yet to offer specific direction for the hydropower sector, but comments made during a White House town hall held in early April offer clues that would indicate he agrees with Walden's sentiment.

Although the meeting was intended to discuss the permitting difficulties faced across all industry sectors in executing both rehabilitation and new construction projects, Trump singled out dams and hydro as areas that have suffered under existing regulatory hurdles.

"They don't even talk about dams anymore," the president said. "And you know, hydropower is a great, great form of power. But we don't even talk about it because the permits are virtually impossible. [Hydropower] is one of the best things you can do, but we don't even talk about it anymore."

Related Pages:

Steelhead Counts Stopped at Bonneville Due to Wildfire Smoke by Rich Landers, Spokesman-Review, 9/7/17

Managers Work to Keep Bonneville Dam Going Despite Fires by Anna King, KUOW, 9/7/17

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum