forum

library

tutorial

contact

Farmers Rely on Overseas Customers

to Buy Crops, Boost Prices

by Carol Ryan Dumas

Capital Press, December 15, 2016

|

the film forum library tutorial contact |

|

Farmers Rely on Overseas Customers

by Carol Ryan Dumas

|

Mike Miller knows how important foreign trade is to agriculture.

Mike Miller knows how important foreign trade is to agriculture.

For him and Washington state's 1,900 other wheat farmers, exports are the economic lifeblood. They ship more than 90 percent of their crop to overseas customers such as bakers in Japan and noodle manufacturers in the Philippines and South Korea.

The customers were hard-won.

"We realize that we have a good product. We've spent money for decades building a relationship and reputation. I think we're pretty well-respected," Miller said.

Those customers are vital to the industry, said Miller, who in addition to growing wheat near Ritzville, Wash., is chairman of the Washington Grain Commission and vice chairman of U.S. Wheat Associates, which promotes U.S. wheat overseas.

Washington farmers are not alone. Overall, about half of the U.S. wheat crop is exported, making international markets key to wheat growers across the country, Miller said.

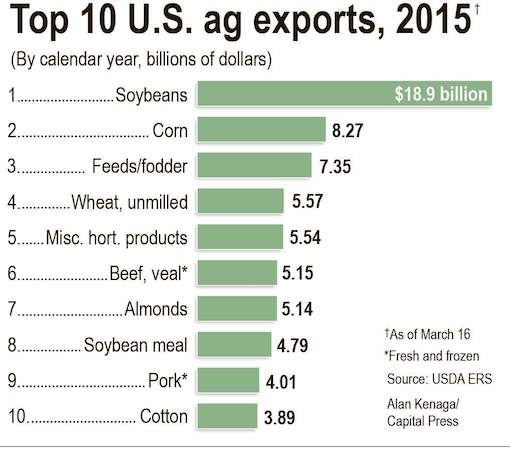

Trade is also critical to other U.S. farmers and ranchers. U.S. agricultural exports totaled $133 billion last year, representing 23 percent of all U.S. ag production and 31 percent of the gross farm income for the nation's 2.1 million farms, according to an analysis by the American Farm Bureau Federation.

That's why any discussion of trade by politicians gets farmers' full attention. President-elect Donald Trump has said he would scuttle the new Trans-Pacific Partnership trade agreement, which includes Japan, Mexico and Canada, three of the largest buyers of U.S. agricultural products.

For some states and crops, exports are the main source of farm revenue. In Washington, for example, 90 to 95 percent of the wheat price farmers receive is attributable to exports, Miller said.

Most of the state's wheat crop travels by barge down the Snake and Columbia rivers or by train before it is loaded onto bulk ships for the voyage overseas, primarily to Asia.

Losing any export markets would be devastating, he said.

"It's all we've got," Miller said, adding that most Washington wheat farmers grow only the one crop.

With the current low price of wheat, that reliance on a single commodity is making things tough. While exports are ahead of pace, leftover wheat from last year's crop is weighing down prices, he said.

"Markets are active, there's just a whole lot of wheat right now," he said.

A lot of relatively new areas of the world are growing wheat, making markets more competitive, and the strength of the U.S. dollar isn't helping, he said. As the dollar's value increases, the buying power of customers in other nations decreases.

Protecting markets

Protecting markets

About one-third of Washington's apple production is exported to more than 60 countries, and the Washington Apple Commission focuses all of its promotional activities on international markets.

"We are very heavily dependent on international markets," said Todd Fryhover, the commission's president. And those exports are critical in protecting the domestic market, he said.

Washington exports 40 million to 50 million 40-pound boxes of apples annually -- more than 90 percent of all U.S. apple exports. The state's orchards grow about 60 percent of all U.S. apples.

The U.S. grows more apples than the domestic market can absorb, Fryhover said.

"It all comes down to supply and demand. If we don't move it out, obviously prices are going to come down … prices are going to decline dramatically," he said.

The West Coast port slowdown from October 2014 to March 2015 offered a dramatic example. The Washington State Tree Fruit Association estimates the International Longshore and Warehouse Union's work slowdown at West Coast container ports cost the state's apple and pear growers $95 million in lost sales.

And that's not counting additional cold storage costs and penalties imposed by importers due to shipping delays, said Tim Kovis, the association's communications manager.

"It had an incredible effect on our industry. It created a huge backlog," Fryhover said.

In addition to the slowdown, Washington was dealing with its largest apple crop in its history. It needed bins in the orchards and space in the warehouse.

"We absolutely needed movement," he said.

Capacity is limited, and apples need to be brought in, packed, sold and shipped. When storage gets full, packing has to stop, he said.

"There's a real need for it to go out immediately," he said.

"Exports are an integral part of the Washington apple industry's business model," said Jon Alegria, a Tieton, Wash., grower-packer and president of CPC International Apple Co. He is also chairman of the U.S. Apple Association and past chairman of the Washington Apple Commission.

More markets mean more fruit sold. Certain sizes and grades that aren't acceptable in the U.S. are desirable in foreign markets, he said.

"You end up selling more of the tree that way," he said.

"Export markets are extremely important. You have to diversify your markets, and you sometimes find a competitive advantage with certain markets," he said.

Closed markets

For the U.S. beef industry, the devastating effect of lost exports came crashing down in December 2003 when a single case of bovine spongiform encephalopathy -- commonly known as mad cow disease -- was found in a Washington state dairy cow that had been imported from Canada. Major export markets such as Japan stopped buying U.S. beef overnight.

Some markets reopened fairly quickly, but the loss was major, said Joe Schuele, vice president of communications for the U.S. Meat Export Federation.

U.S. exports of beef and beef varietal meats shrank from $3.86 billion in 2003 to $809 million in 2004, a drop of 79 percent. The share of production that is exported decreased from 13.5 percent to less than 4 percent.

Exports began to pick up again in 2005 but were still less than $1 billion, Schuele said.

While beef exports are back up to 13.5 percent of production and in 2014 set a record of $7.1 billion, China continued to ban U.S. beef and has only recently announced it is again buying U.S. beef.

Analysts estimate the lack of access to China is costing the beef industry more than $100 for every head of fed cattle produced in the U.S., Schuele said.

"Whenever you have markets closed there it is a definite loss to the industry. China is the last really needle-moving market … it really impacts overall demand," he said.

China's beef imports were a record $2.3 billion in 2015 and were expected to increase 67 percent this year, according to USDA.

The loss of access to Russia is also costing U.S. commodities, including the beef industry, which once rang up $300 million in annual sales there, Schuele said.

Russian President Vladimir Putin banned the import of food from the U.S. and EU after they sanctioned his nation for taking over Crimea and intervening in Ukraine in 2014.

The value of beef exports this year is about $253 per head of all U.S. fed cattle, down from the peak of $300 per head in 2014 but double what it was five or six years ago. While returns to each sector of the industry vary, exports are an important part of revenue for the whole sector, Schuele said.

Given the current herd expansion and a larger beef supply ahead, it will be imperative to move product through exports, he said.

"Expanding and opening new global markets for U.S. beef is critical to the economic viability of Idaho's beef industry and producers like us," said Laurie Lickley, a Jerome, Idaho, cow-calf producer and immediate past-president of the Idaho Cattle Association.

"Our trading partners, with a growing middle class, recognize our premium domestic product and are willing to pay us for it. However, we must negotiate not only free trade with those countries but, more importantly, fair trade," she said.

Increasing reliance

Continued strong exports are essential to California's almond industry.

"We're anticipating a fairly significant increase in production in the next three to five years," said Julie Adams, vice president of global, technical and regulatory affairs for the Almond Board of California.

High-value commodities continue to be the crop of choice in California, which is seeing additional almond tree plantings and greater efficiency in production.

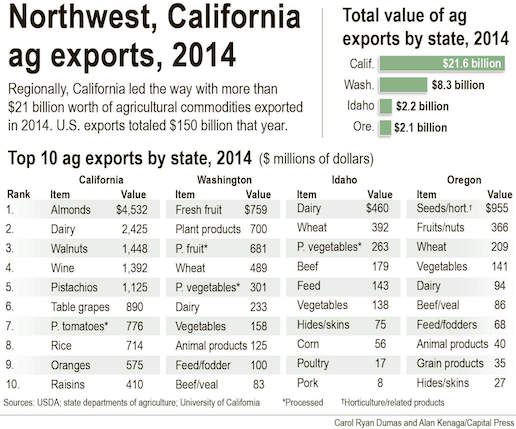

Almonds are the No. 1 specialty crop export in the U.S. and California's No. 1 ag export. The state grows 100 percent of U.S. almonds and accounts for 80 percent of global production. California's almond exports were valued at about $4.5 billion in 2015.

Exports continue to be a "very significant" opportunity for California almonds, and growers invest quite a bit in marketing programs in many countries, Adams said.

"We're seeing a lot of growth in virtually all our overseas markets," she said.

Any disruption in exports makes it difficult for customers who rely on California almonds and difficult for the industry. Such was the case in the port slowdown two years ago, she said.

"We estimate that the slowdown resulted in hundreds of containers delayed, dozens of canceled orders and rerouted shipments at considerably greater expense, as well as hundreds of thousands of dollars in congestion and other charges," she said.

With one of the few Mediterranean climates in the world, California is the global supplier to an almond-hungry world, said Mike Mason, a Shafter, Calif., grower and owner of Supreme Almonds of California and chairman of the Almond Board of California.

The U.S. is by far the largest single consumer of almonds, but the export share of production illustrates the significance of exports to almond growers. If something happens in those markets, it's going to affect the almond community and those consumers in other countries because they don't have a lot of options, he said.

With 70 percent of the crop heading for foreign markets, a shutdown in exports would be an "absolute disaster," said Daniel Sumner, director of the University of California Agricultural Issues Center.

"What we know in agriculture is a small shift in demand at the wrong time of year -- and prices collapse," he said.

Because California exports about one-fourth of its nearly $40 billion in annual agricultural production overseas sales are crucial for success, he said.

Biggest challenge

A slowing in exports translates into significantly lower domestic prices as markets correct for excess supply, said Doug Robison, Northwest Farm Credit Services senior vice president for Western Idaho.

"You can see a 10 percent to 15 percent swing in price just on a few percent change in surplus or shortfall," he said.

The biggest swing factor in U.S. export markets is the U.S. dollar. A strong dollar makes U.S. products more expensive, he said.

"At the end of the day, the U.S. dollar strength is going to be the biggest influencer of commodity prices here in the U.S.," he said.

One of the strengths of U.S. agriculture is it's typically been a net exporter, but the acceleration of the value of the U.S. dollar has narrowed that net trade surplus considerably, he said.

The U.S. agricultural trade surplus declined 49 percent in 2015, from $38.3 billion in 2014 to $19.5 billion, and it's expected to drop to $13.9 billion in 2016, according to USDA.

Continued strengthening of the dollar will be a headwind, Robison said.

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum