forum

library

tutorial

contact

Solar Power Eclipsed Wind in 2013

and is Set to Keep Rising

by Mark Jaffe

Denver Post, March 26, 2014

|

the film forum library tutorial contact |

|

Solar Power Eclipsed Wind in 2013

by Mark Jaffe

|

Solar power is set to eclipse wind as the best-financed, most-installed renewable energy source, says Clean Energy Trends 2014.

Solar power is set to eclipse wind as the best-financed, most-installed renewable energy source, says Clean Energy Trends 2014.

In 2013, more solar photovoltaic generating capacity was installed worldwide than wind power, according to the trend report by Clean Edge Inc. a clean-tech sector research advisory firm, with offices in San Francisco and Portland, Oregon.

"This was the cross-over year," said Ron Pernick, Clean Edge's managing director. It was the first time the 14 years Clean Edge has done the report that solar out-performed wind.

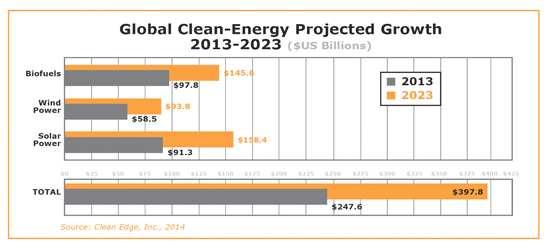

There were 36.5 gigawatts of PV installed, with record levels of installations in China, Japan and the U.S., compared with 35.5 GW of wind in 2013. The solar market was worth $91.3 billion and the wind market $58.5 billion.

Wind generation is still two-and-half times as large as solar, but market and technological forces are in solar's favor, Pernick said.

"Solar has quite away to go," Pernick said. "There is a high-tech component, economies of scale, falling prices and new financing mechanisms that are driving the market."

"Wind farms are basically steel in the ground and you are talking about big installations," Pernick said. "Solar has the advantage of being able to sell distributed generation." although, it is worth noting that the wind industry has expanded its market with improved blade designs, higher towers and more efficient turbines. This has enabled wind power to become economical in lower wind areas. "There is also a potentially big market in offshore wind," Pernick said.

The global average price for an installed PV system has dropped to $2.50 a watt in 2013 from $7.20 in 2007. Clean Edge projects prices continuing to fall, reaching $1.12 a watt in 2023.

Clean Edge is forecasting a 73 percent growth in the solar market in the next 10 years to $158.4 billion, while wind will grow 60 percent to $93.8 million.

"This incredible evolution in price and the advent of new financing models -- from Mosaic's crowd-funding to Wells Fargo funding $100 million of Sun Edison projects -- are coming together in a unique way," Pernick said.

There was a troubling trend in terms of venture capital funding for clean tech sector as it dropped in total dollars and as a portion of overall venture capital investment, Pernick said.

U.S. venture capital clean tech investments in 2013 were $4.3 billion, down 25 percent from 2012. More troubling, Pernick said, is that clean tech's share of total venture investments slipped to 14.9 percent from 25.2 percent in 2011.

It is a very different environment when 20 percent of venture capital dollars go to clean tech and when it is 15 percent or 10 percent," Pernick said.

After some high-profile bankruptcies in the sector -- such as thin-film solar panel maker Solyndra and battery maker A123 Systems -- that wiped out billions of investor dollars, VC firms pulled back.

"There has been a movement into companies that Silicon Valley venture capitalists understand, IT and web-based companies -- dealing with services and big data," Pernick said.

The biggest 2013 deal was $258 million for the ride-sharing service Uber. Lyft, another ride-sharer, also netted $60 in venture investment.

Picking up some of the financing slack are large corporations and financial firms around, the study said. Google's reported $3.2 billion acquisition of Nest, Labs, the maker of smart thermostats, is a prime example.

"Total VC investment was about $4.4 billion and the Google deal was worth $3.2 billion, so that tells you something," Pernick said.

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum