forum

library

tutorial

contact

Wind Power Hits a Trough

by Jeffrey BallWall Street Journal, April 5, 2011

|

the film forum library tutorial contact |

|

Wind Power Hits a Trough

by Jeffrey BallWall Street Journal, April 5, 2011 |

HOUSTON--Gabriel Alonso, who runs one of America's biggest wind-farm developers, often reminds his employees their goal isn't to stage a renewable-energy revolution.

HOUSTON--Gabriel Alonso, who runs one of America's biggest wind-farm developers, often reminds his employees their goal isn't to stage a renewable-energy revolution.

"This is about making money," the chief executive of Horizon Wind Energy LLC tells his troops. And right now, his strategy is to retrench.

Head winds have clouded the short-term outlook for wind power, particularly in the U.S. Above, a Suzlon turbine rotor on the ground during construction of a wind farm in Illinois last fall.

After years of blustery growth, wind power is facing a blow-back in some of its major markets. It is reeling from lackluster electricity demand in many mature economies, rock-bottom prices for competing natural-gas in the U.S. and uncertainty throughout much of the world about government subsidies. Companies that make wind turbines are slashing production at some plants and reconsidering previous expansion.

Wind power is the biggest and cheapest of the renewable-energy sources now attracting major investment, from solar to biofuels to ocean waves, analysts say. Bigger blades, taller towers and slicker software all have improved the efficiency of the massive, pinwheel-style turbines that now dot landscapes from Iowa to India. The uncertain outlook for nuclear power after the Japan disaster should boost wind power's appeal.

Yet wind remains a tiny slice of the energy pie. In the U.S, it generated about 2% of electricity in 2009, the most recent year for which statistics are available, the U.S. Energy Information Administration says. World-wide, it generated about 1% of electricity in 2008, the most recent global numbers available, the International Energy Agency says.

Some day, government studies say, wind could produce 20% of electricity in the U.S., about the same percentage as wind now provides in Denmark. But that would require building massive, pricey transmission lines to move the power from the Midwest, where the heaviest winds blow, to the coasts, where major cities sit. Bids to develop those lines have hit political head winds.

Short of building huge new high-voltage lines, one way to increase wind power would be to devise an economic way to store wind power so it is usable even after the breezes die down. Entrepreneurs are working on a host of options, including batteries, but prices remain high.

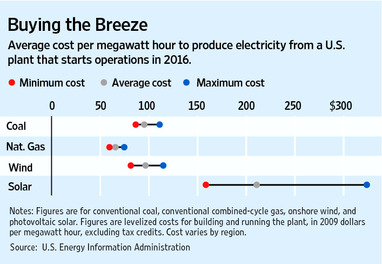

Most of the cost of wind power comes from putting up the wind turbines, because the fuel--the breeze--is free. By contrast, with coal- or gas-fired power, much of the cost comes not in initially building the plant, but in continually buying the fossil fuel.

The price consumers pay for wind power varies widely from place to place. A turbine mounted in a spot where the wind blows steady and hard, such as the Great Plains, typically cranks out more electricity each year than it does in a spot where the wind is patchier and weaker, such as the Northeast. As a result, each bit of wind power--a "megawatt-hour" of the green juice--tends to sell for less in the Great Plains than it does in the Northeast.

The Energy Information Administration projects that, in 2016, the cost of producing electricity from a new wind farm will be about equal to that from a new gas-fired plant in the windiest parts of America's midsection, such as the Dakotas and Colorado. It forecasts that producing wind power still will cost about twice as much as producing gas-fired power in less-windy places such as the Mid-Atlantic coast and the Southeast.

For years, governments in much of the world have provided tax breaks to wind-power producers and required that electric utilities buy the green juice at above-market rates. The main motive was to spur domestic energy production, both to counter volatile natural-gas prices and to generate more jobs.

See how much energy each state produces from renewable sources, and a breakdown of these sources.

But recently came a double-whammy. Massive, new natural-gas discoveries in the U.S. slashed the price of the fuel that wind competes most directly against. And the recession slowed demand for new power plants of any kind, leading more politicians to question renewable-energy subsidies. Congress has declined so far to pass a nation-wide renewable-energy requirement.

Some major wind-turbine makers are cutting production at some factories. More than a year ago, Suzlon Energy Ltd., an Indian company that is one of the world's biggest wind-turbine makers, began laying off workers at its plant in Pipestone, Minn., which makes blades for turbines; the plant now is operating at just one-third of its capacity, says Tulsi Tanti, the company's chief executive. Given the lack of a nation-wide renewables mandate, he says, Suzlon also has postponed plans to build another U.S. factory, in Texas.

Some wind-farm developers also are reconsidering expansion plans. The world's biggest wind-power developer, Spain's Iberdrola SA, announced last month it is halving wind-farm-development plans for 2012.

Companies still building wind farms are doing so not just where the winds are strong, but where the subsidies are rich.

Houston-based Horizon typifies the trend. Its corporate predecessor was founded in the late 1990s by some scrappy U.S. wind-farm developers. Goldman Sachs Group Inc. bought it in 2005, then sold it to Energias de Portugal SA in 2007.

The Lisbon-based utility had exploited generous renewable-energy incentives in Europe to boost its wind-power businesses. It bought Horizon to break into the U.S. and soon spun off its renewable-energy business as a separate company.

Under its European owners, Horizon increased its installed wind-power capacity more than fivefold between 2007 and 2010. Then the company began playing defense.

In Illinois, for instance, lawmakers were considering easing the state's renewable-energy law. "We were able to convince" them to keep the tougher mandate, Mr. Alonso says.

That win paid off last December, when Horizon landed 20-year contracts to sell power from two of its Midwest wind farms to two utilities that faced obligations under the Illinois law. But even that deal underscores wind's current squeeze.

The price wind developers such as Horizon contracted in December through the Illinois Power Agency, the government office that oversaw the deals, was about 20% less than wind-power developers received under contracts signed in 2009, said Matthew Kaplan, an analyst with IHS Emerging Energy Research, a Cambridge, Mass., consultant. The wind industry, he says, is rushing to lock in buyers for its juice amid "a glut" of wind farms that were planned or built when natural-gas prices were high. And today's low gas prices are forcing wind-turbine makers to trim costs--a shift that should make wind power more economically competitive, he says.

Horizon is slashing by more than half the number of turbines it had planned to install this year. Most of the wind farms it builds won't be in the blowy Midwest. They'll be on the coasts, where states tend to compensate for their less-robust winds with bigger helpings of another resource: government policies pushing renewable energy. In California and several Northeastern states, utilities typically are paying roughly $80 per megawatt hour for long-term wind-power contracts--some 50% above the price in breezier Illinois.

Without renewable-energy mandates, Horizon's Mr. Alonso says, most wind farms would be built only where they are economically competitive: in the nation's midsection. That, he says, would mean that wind "wouldn't become a sustainable source of growth for the country."

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum